Personal Finance 101

Personal Finance is a broad term that relates to how you manage your money, with common focus areas being budgeting, saving and investing. However, it covers everything from banking, insurance, mortgages, retirement planning, and tax and estate planning. We believe that financial health like physical, emotional and mental health, is key to living a fulfilling and enjoyable life. Unfortunately, just like the others, it takes work. So let us take a look at what you can do to make your journey towards greater financial health more successful.

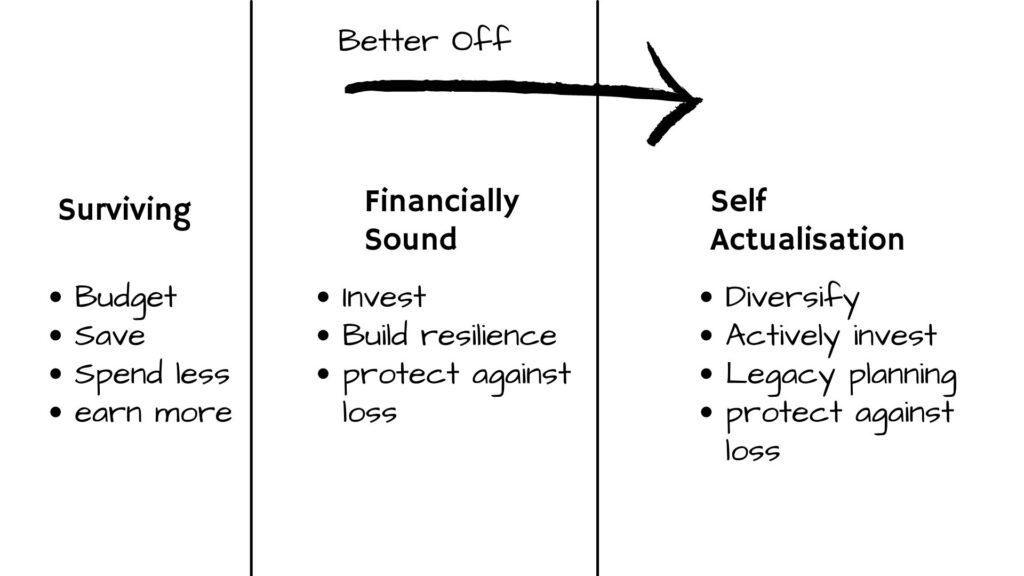

Broadly speaking there are 3 phases of personal finance; surviving, soundness & self-actualisation. Take time to see where you are, be honest with yourself, and remember all progress requires is purpose. Then take note of the financial habits and decisions you need to progress

Surviving.

It seems like all you can do is stay afloat, sometimes that is a struggle too. Or maybe like many the past few years have left you on hard times -the bills are growing faster than the cash is coming in, your debt is discouraging, you never seem to have enough and money is an uncomfortable topic. Well, the remedies here are not going to sound new but the implementation of these simple principles can change your life.

1. First step track where your money is going. Use a pen and paper, an excel sheet or an app just figure out how much you are spending and why?

2. Make a budget and use it! Prioritise your needs and highlight the non-essentials

3. Cut back on expenses. The one sure-fire way to have more money at the end of the day is to spend less of it. Look at your budget what can you cut out? What can you substitute? Remember shaving $100 off rent is a bigger saving than that $2 daily coffee

4. Start saving! Build up 3 months’ worth of cash. You need resilience but be patient and consistent.

5. Earn more – find a way to increase your income generation. Invest in yourself, take a course, get a mentor, learn a new skill, and ask what your boss needs to see before you get a promotion or start a side hustle or change jobs but the goal is the same find a way to earn more.

Soundness.

Being financially sound tends to be an underappreciated situation in this social media era of jet-setting and wearing luxury brands for no reason, but let us look at it with fresh eyes. A financially sound person is referred to “as being financially healthy and having the ability to make favourable financial decisions. Additionally, financially sound individuals or decisions are characterized by stability, security, and progress.” [Due.com] Another definition of a financially sound person is someone who can live comfortably off 70%-80% of their net income with the rest going towards investments and savings. Sounds pretty good to me. So how do you cement your place in the financially sound and propel yourself even further?

1. Build resilience. Now that things are going well you need to safeguard yourself from the shocks life throws at all of us. One way to do this is to create an emergency fund of 6 months worth of expenses – given the high rates of inflation, we suggest you build your emergency by accumulating the equivalent in liquid well-performing assets that are easy to cash out. You can do so easily by using Level. (shameless plug)

2. Start investing. You have worked hard (or been quite lucky) to get where you are, now it’s time to get your money to start working for you. Look at the life you want to live, set goals for yourself and follow through. Investing is about consistency more than anything else.

3. Protect yourself against loss. It only makes sense that as you begin to accrue assets and build wealth you must start to safeguard them. Look into insurance – personal, family. and asset

4. Educate yourself – this investment pays the highest return

Self Actualisation.

This is the ultimate level of financial freedom. I once joked that financially self-actualised people seldom keep receipts and when they do it’s either out of curiosity or for tax purposes. But financial freedom means different things to different people, but whether you think of it in terms of holidays and name brands or like retiring and not thinking about rent and bills here is a common thread. Someone who is financially free tends to be content with their finances, happy with their cashbook and not worried about any expenses or lifestyle choices, they comfortably afford their needs as well as wants in less than 50% of their income and are taken to invest in their passions and enjoy hobbies. If you are breathing the sweet rarified air of being well off I suggest you do the following if you aren’t already.

1. Diversify. Look at your portfolio and make sure you haven’t overconcentrated your holdings. Indeed there might be a generous cash cow but diversity protects against hefty losses in case of shocks or downturns.

2. Actively invest. Now is the time to start actively investing a section of your portfolio (10%-20%) beyond the traditional capital markets. You could start a business, become an angel investor in some startups doing innovative things in industries you find interesting or maybe you could pursue a passion of yours and share it with others like building an art gallery or sponsoring music lessons for some talented but less privileged individuals. Basically, find a way to have fun with your money.

3. Make plans. Plan your retirement, plan for your family and estate, and write/update your will. Too often successful people put off this bit because it is uncomfortable and end up leaving behind a huge bitter mess.

4. Hire professionals. The wealthier you get the more value there is in professional financial services; investment advisors, accountants and tax consultants can save you more than they cost once you start to deal with substantial sums of money.

In wrapping up this not-so-brief look at personal finance I would like to stress two things. Firstly the pursuit of financial freedom is a journey, not a race, and each journey and its destination is set and travelled by you! Don’t let other people’s expectations drive you astray. Secondly, purpose spurs progress, regardless of current financial conditions, age, luck, inheritance etc it is your purposefulness that will get you where you want to be financial.

If you found this interesting and like this kind of stuff you can sign up to be notified when a new article is posted. You can also sign up to Level for free today and begin investing in Africa right away