May 2025 Bank Of Uganda Treasury Bond Auction – Results & What It Means for You

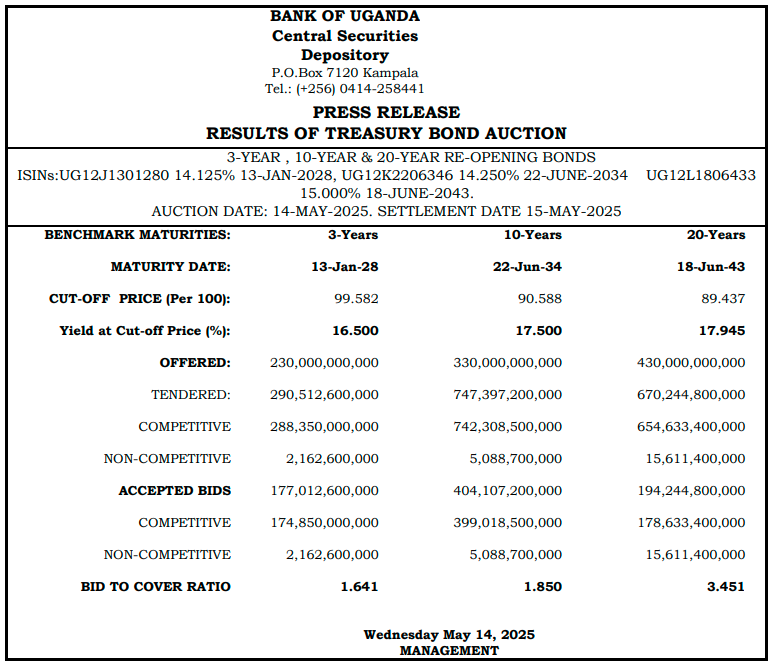

On May 14, 2025, the Bank of Uganda held a treasury bond auction featuring 3-year, 10-year, and 20-year government bonds. These were reopenings of previously issued bonds — meaning they’re not brand new but are being offered again to raise more funds from the public.

The following bonds were reopened in this auction:

- UG12J1301280 – 14.125% 3-Year Bond maturing 13-Jan-2028

- UG12K2206346 – 14.250% 10-Year Bond maturing 22-Jun-2034

- UG12L1806433 – 15.000% 20-Year Bond maturing 18-Jun-2043

Let’s break down the numbers and what they mean for you as an investor.

What Bonds Were Offered and at What Rates?

| Bond Term | Maturity Date | Cut-off Yield (Interest Rate) | Amount Raised |

|---|---|---|---|

| 3-Year | 13 Feb 2028 | 16.50% | UGX 174.85 billion |

| 10-Year | 22 Jun 2034 | 17.50% | UGX 399.02 billion |

| 20-Year | 18 Jun 2043 | 17.95% | UGX 654.63 billion |

The cut-off yield is the fixed interest rate you lock in when you successfully invest in that bond. The longer the bond’s term, the higher the rate tends to be — because your money stays invested for longer.

What These Results Tell Us

- Strong investor demand. For the 20-year bond alone, investors placed bids worth over UGX 670 billion. In total, the government accepted more than UGX 1.2 trillion across all three bonds.

- The 3-year bond offered a solid return at 16.50%, a good short-to-mid-term option for people planning ahead for things like school fees or business capital.

- The 10-year bond, with a 17.50% yield, suits investors thinking about buying land, starting long-term projects, or building a stable income stream.

- The 20-year bond came with the highest return of 17.95%, ideal for retirement or legacy planning.

Across all three, the message is clear: more Ugandans are turning to treasury bonds as a safe and rewarding way to grow their money.

How Much Could You Earn?

Let’s say you invest UGX 1,000,000 in the 10-year bond at 17.50%.

- You’d receive UGX 175,000 every year, paid in two parts (every 6 months)

- Over 10 years, you’d earn UGX 1,750,000 in interest

- At the end of 10 years, you get back your full UGX 1,000,000

That’s real, predictable income — perfect for long-term planning.

How to Invest in Treasury Bonds via Level Africa

You don’t need to visit a bank or fill out complex forms. With Level Africa, the process is fully digital and beginner-friendly.

Here’s how to get started:

- Create an account on Level Africa

- Upload your National ID or Passport (KYC)

- Go to “Treasury Bonds” under Products

- Choose a bond based on your goals and preferred term

- Deposit money into your wallet

- Place your order – bonds marked “Available” can be bought instantly

- Track your interest earnings and bond status online

Final Thoughts

The May 2025 bond auction once again shows that treasury bonds remain one of the safest and most reliable investment options in Uganda. Whether you’re looking for short-term growth or long-term stability, there’s a bond for every goal.

And now, with Level Africa, investing is easier than ever.

Start Now – Create an Account on Level Africa

Join our community of like minded investors like yourself today Building Wealth With Level Africa.

Stay updated by following our WhatsApp channel.

Frequently Asked Questions About Treasury Bonds in Uganda

What are government bonds?

Government bonds are a way to lend money to the Government of Uganda. In return, the government pays you a fixed interest rate every 6 months and gives back your full investment at the end of the bond’s term.

How do treasury bonds work in Uganda?

You buy a bond (e.g. 3, 5, or 10 years), the government pays you interest every 6 months, and you get your full capital back when the bond matures. All bonds are issued and regulated by the Bank of Uganda.

What is the minimum amount to invest in government bonds?

You can start investing with UGX 100,000 using a non-competitive bid. No broker is needed when using platforms like Level Africa.

How can I buy government bonds in Uganda?

You need a Central Depository System (CDS) account or a digital investment platform like Level Africa.

Steps:

- Create an account on Level Africa

- Upload your National ID or Passport (KYC)

- Go to “Treasury Bonds” under Products

- Choose a bond that matches your investment goals

- Deposit funds into your wallet

- Place your order — instantly if marked “Available”

- Track your bond and earnings from your dashboard

What are the current treasury bond interest rates in Uganda (2025)?

Rates vary by bond type and auction results. For example:

- 2-Year bond: around 15.75%

- 10-Year bond: around 16.25%

- 20-Year bond: up to 18.50%

All rates are set during each auction by the Bank of Uganda.

Are treasury bonds safe in 2025?

Yes. Treasury bonds are backed by the Government of Uganda and are considered among the safest investments, especially for long-term or retirement goals.

Do government bonds pay interest?

Yes. Interest is called a coupon and is paid out every 6 months. You receive it directly to your wallet or bank account.

Can I sell a bond before it matures?

Yes, bonds are transferable and can be rediscounted if you need to exit early, although the resale price depends on current market rates.

How do interest rates affect bonds?

If new bond rates go up, the value of existing bonds on the market may go down (and vice versa). However, if you hold your bond until maturity, you still get your full investment and all promised interest.

What’s the difference between treasury bonds and treasury bills?

- Treasury bonds: Long-term (2–25 years), pay interest every 6 months

- Treasury bills: Short-term (91–364 days), sold at a discount and paid back in full at maturity

Can individuals buy Bank of Uganda treasury bonds?

Yes. Both individuals and institutions can invest. Many Ugandans now use Level Africa to access bonds directly with no paperwork.

How often are treasury bonds auctioned in Uganda?

Typically, every 28 days. The auction calendar is published annually by the Bank of Uganda, and Level Africa notifies you ahead of each sale.