March 2025 Bank Of Uganda Treasury Bond Auction – Results & What It Means for You

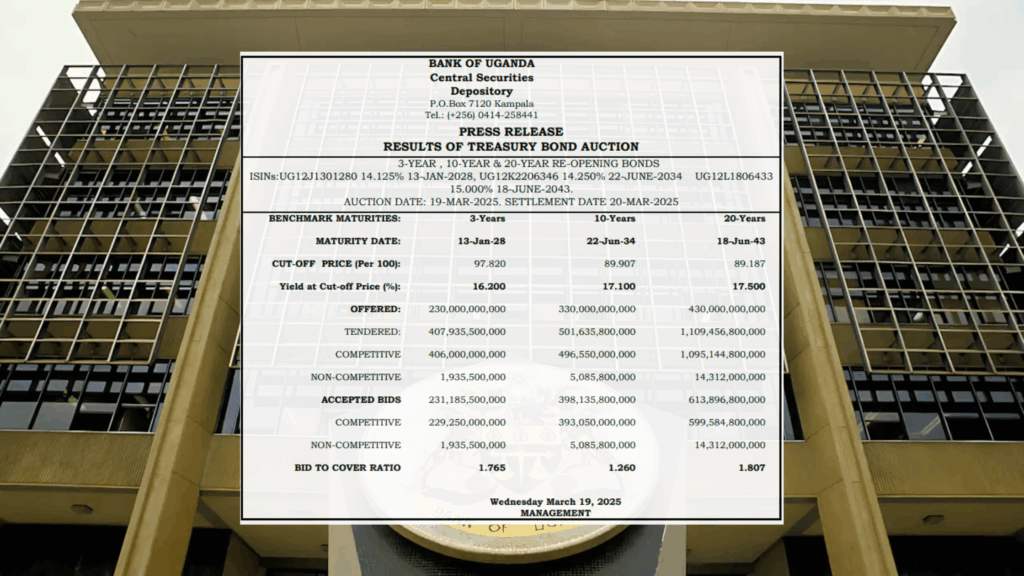

On March 19, 2025, the Bank of Uganda reopened three types of treasury bonds: 3-year, 10-year, and 20-year. These were not new bonds — they had been issued before and were made available again for new investors to buy.

The following bonds were reopened in this auction:

-

UG12J1301280 – 14.125% 3-Year Bond maturing 13-Jan-2028

-

UG12K2206346 – 14.250% 10-Year Bond maturing 22-Jun-2034

-

UG12L1806433 – 15.000% 20-Year Bond maturing 18-Jun-2043

What Bonds Were Offered and at What Rates?

| Bond Term | Maturity Date | Cut-off Yield (Interest Rate) | Amount Raised |

|---|---|---|---|

| 3-Year | 13-Jan-2028 | 16.20% | UGX 229.25 billion |

| 10-Year | 22-Jun-2034 | 17.10% | UGX 393.05 billion |

| 20-Year | 18-Jun-2043 | 17.50% | UGX 599.58 billion |

The cut-off yield is the interest rate investors will earn if their bid is accepted. Generally, the longer the bond’s term, the higher the return — to reward investors for committing their money for a longer period.

What These Results Tell Us

-

Demand was high: The 20-year bond alone attracted over UGX 1.1 trillion in bids. That’s almost double what the government was offering.

-

The 3-year bond gives a return of 16.20%, a strong option for those saving toward near-term goals like school fees or business expenses.

-

The 10-year bond, yielding 17.10%, is great for mid- to long-term goals like land purchase, home building, or funding children’s education.

-

The 20-year bond, paying 17.50%, is perfect for long-term investors planning for retirement or building generational wealth.

Example: What You Could Earn

If you invested UGX 1,000,000 in the 10-year bond at 17.10%, here’s how it would grow:

-

You’d receive UGX 171,000 per year, paid every 6 months

-

Over 10 years, you’d earn UGX 1,710,000

-

Your original UGX 1,000,000 is returned at maturity

That’s over 70% return, guaranteed, and paid out like a salary.

How to Invest in Treasury Bonds via Level Africa

Level Africa lets you invest in government bonds without leaving your home.

Here’s how to start:

-

Create an account on Level Africa

-

Upload your National ID or Passport (KYC)

-

Go to “Treasury Bonds” under Products

-

Choose a bond that fits your timeline

-

Deposit funds into your Level wallet

-

Place your order — bonds marked “Available” can be purchased instantly

-

Track your returns online

Final Thoughts

The March 2025 auction proves once again that treasury bonds are one of the best options for Ugandans who want to grow their money safely. With returns over 16% and backed by the government, they offer stability, income, and growth.

And now with Level Africa, investing has never been easier.

Start Now – Create an Account on Level Africa

Join our community of like minded investors like yourself today Building Wealth With Level Africa.

Stay updated by following our WhatsApp channel.

Frequently Asked Questions About Treasury Bonds in Uganda

What are government bonds?

Government bonds are a way to lend money to the Government of Uganda. In return, the government pays you a fixed interest rate every 6 months and gives back your full investment at the end of the bond’s term.

How do treasury bonds work in Uganda?

You buy a bond (e.g. 3, 5, or 10 years), the government pays you interest every 6 months, and you get your full capital back when the bond matures. All bonds are issued and regulated by the Bank of Uganda.

What is the minimum amount to invest in government bonds?

You can start investing with UGX 100,000 using a non-competitive bid. No broker is needed when using platforms like Level Africa.

How can I buy government bonds in Uganda?

You need a Central Depository System (CDS) account or a digital investment platform like Level Africa.

Steps:

- Create an account on Level Africa

- Upload your National ID or Passport (KYC)

- Go to “Treasury Bonds” under Products

- Choose a bond that matches your investment goals

- Deposit funds into your wallet

- Place your order — instantly if marked “Available”

- Track your bond and earnings from your dashboard

What are the current treasury bond interest rates in Uganda (2025)?

Rates vary by bond type and auction results. For example:

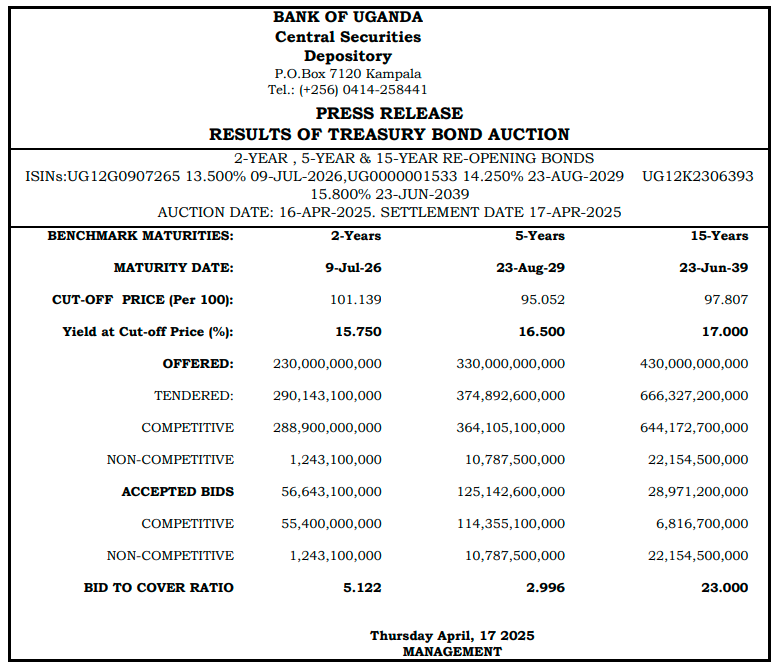

- 2-Year bond: around 15.75%

- 10-Year bond: around 16.25%

- 20-Year bond: up to 18.50%

All rates are set during each auction by the Bank of Uganda.

Are treasury bonds safe in 2025?

Yes. Treasury bonds are backed by the Government of Uganda and are considered among the safest investments, especially for long-term or retirement goals.

Do government bonds pay interest?

Yes. Interest is called a coupon and is paid out every 6 months. You receive it directly to your wallet or bank account.

Can I sell a bond before it matures?

Yes, bonds are transferable and can be rediscounted if you need to exit early, although the resale price depends on current market rates.

How do interest rates affect bonds?

If new bond rates go up, the value of existing bonds on the market may go down (and vice versa). However, if you hold your bond until maturity, you still get your full investment and all promised interest.

What’s the difference between treasury bonds and treasury bills?

- Treasury bonds: Long-term (2–25 years), pay interest every 6 months

- Treasury bills: Short-term (91–364 days), sold at a discount and paid back in full at maturity

Can individuals buy Bank of Uganda treasury bonds?

Yes. Both individuals and institutions can invest. Many Ugandans now use Level Africa to access bonds directly with no paperwork.

How often are treasury bonds auctioned in Uganda?

Typically, every 28 days. The auction calendar is published annually by the Bank of Uganda, and Level Africa notifies you ahead of each sale.